Compliance Regulations for BNPL Lenders

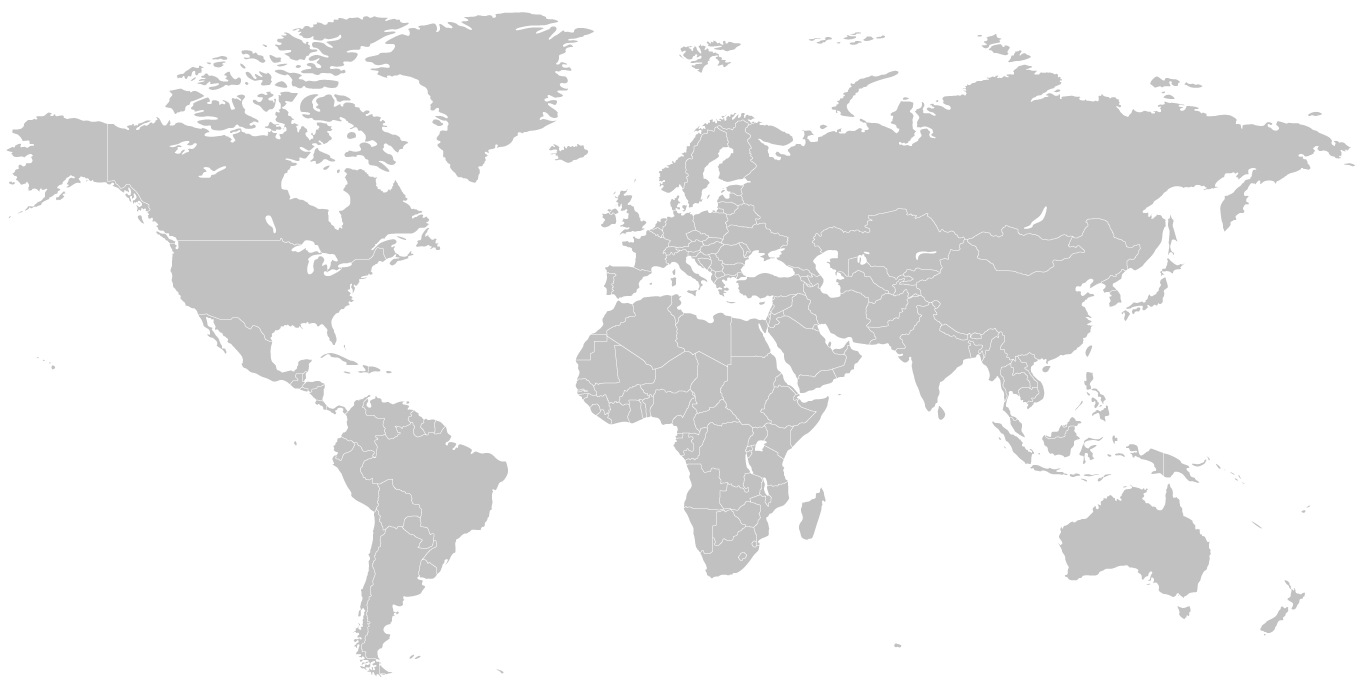

Regulations specific to Buy Now, Pay Later lending vary by country

Click on a location below to see the latest regulatory updates in that country

United States

In May 2024, the CFPB issued an interpretive rule classifying BNPL products accessed through digital user accounts as "credit cards" under Regulation Z. This means BNPL providers must now comply with credit card regulations, including:

- Investigating consumer disputes and pausing payment requirements during investigations

- Refunding consumers for returned products or canceled services

- Providing cost of credit disclosures and periodic billing statements

The OCC released a bulletin to assist banks in effectively managing risks associated with BNPL lending and in offering BNPL loans in a responsible manner. The OCC expects banks that offer BNPL loans to do so in a manner that is safe and sound, provides fair access to financial services, supports fair treatment of consumers, and complies with applicable laws and regulations.

The FTC also called out BNPL lenders specifically, publishing a blog post titled "Buy now, pay later – and comply with the FTC Act immediately" in which they warn BNPL lenders—and those involved in the BNPL ecosystem, such as marketers—to comply with existing consumer protection laws.

United Kingdom

The UK government published draft legislation in 2023 to regulate BNPL credit agreements under the Financial Conduct Authority (FCA). BNPL agreements will require authorization and must meet statutory obligations, including creditworthiness assessments and clear pre-contractual disclosures.

Regulatory controls include:

- Advertising: BNPL ads must be approved by an FCA-authorized firm.

- Credit Checks: BNPL providers must assess creditworthiness and report to credit agencies.

- Pre-Contract Info: Must follow FCA rules instead of the strict CCA rules.

- Marketing Rules: Distance marketing rules adjusted to avoid duplicate disclosures.

- Agreement Content: Must meet specific format and content requirements.

- Consumer Protection: Extends Section 75 protections to BNPL.

- Handling Arrears: CCA rules for financial difficulty apply.

- Complaints: Consumers can file complaints with the Financial Ombudsman Service.

Europe Union (EU)

In 2023, the EU implemented a new BNPL code of conduct and updated the Consumer Credit Directive. Under these updates, BNPL providers must obtain licenses and comply with responsible lending standards by November 2025, with full enforcement by November 2026.

Some notable requirements for providers include:

- Ensuring BNPL services are not offered to consumers under 18

- Avoiding offering BNPL services if it would be irresponsible given the consumer’s financial capacity.

- Preventing debt accumulation by not providing new BNPL services to consumers in payment arrears.

- Charging collection fees only after sending a notice of default, with costs capped according to the Dutch Collection Costs Act

Australia

In March 2024, the Australian federal government released legislation to regulate BNPL arrangements as "low cost credit contracts" (LCCCs).

The legislation, called the Treasury Laws Amendment Bill 2024, aims to regulate BNPL by:

- Including BNPL contracts within the National Consumer Credit Protection Act 2009 and National Credit Code

- Requiring BNPL firms to run credit checks on borrowers

- Requiring LCCC providers to hold an Australian Credit Licence (ACL)

- Introducing an opt-in responsible lending framework for LCCC providers

- Introducing fee caps for late or missed payment charges

- Imposing additional warning and disclosure requirements

Ireland

As of 2022, the Central Bank of Ireland (CBI) has regulated BNPL providers through the Consumer Protection (Regulation of Retail Credit and Credit Servicing Firms) Act 2022.

This legislation requires BNPL providers to be authorized by the CBI as either a retail credit firm or a credit servicing firm. They must also adhere to the Consumer Protection Code 2012, which includes rules that protect consumers from taking on too much debt.

These rules require BNPL providers to:

- Assess a consumer's creditworthiness and affordability before granting credit

- Ensure that BNPL credit is suitable for the consumer

- Limit interest rates to 23% APR, unless provided by moneylenders

Sweden

Sweden passed the Swedish Payment Services Act in 2020, aimed to discourage online shoppers from paying with credit—including BNPL products. The Act requires merchants to present the payment methods that do not put the consumer into debt and forbids them from pre-selecting paying by invoice or installment loans in their online checkout.

Currently, BNPL is only regulated under the Swedish Consumer Credit Act, which implements the EU's Consumer Credit Directive.

California, U.S.

Back in 2020, the California Department of Financial Protection and Innovation (then known as the Dept for Business Oversight or “DBO”) took several actions against BNPL companies for issuing illegal loans, referring back to the California Civil Code which defines a loan as “a contract by which one delivers a sum of money to another, and the latter agrees to return at a future time a sum equivalent to that which they borrowed.”

As part of this, the DFPI concluded that point-of-sale (buy-now-pay-later) financing transactions may be deemed loans when:

- The consumer, merchant, and third-party financer treat the transactions like loans, despite contradictory language in the applicable contracts

- The relationship between merchant and third-party financer is extensive

- The role of the third-party financer and all financing terms are not clearly disclosed to the consumer

- The financing transaction is not otherwise regulated

Canada

In November of 2021, the Financial Consumer Agency of Canada (FCAC) published a study on BNPL services with the goal of broadening the Agency’s understanding of the BNPL market in Canada, from the perspective of Canadian consumers.

Currently, it doesn't seem that Canada is moving towards specific regulations for BNPL services. Ontario's updated Consumer Protection Act will not include explicit BNPL references, but requires future performance agreements to be clear and written. Consumers can withdraw from such contracts within a year if goods or services are misrepresented. The Financial Services Regulatory Authority (FSRA) of Ontario also has no specific BNPL guidelines, but expects credit unions to have risk management policies in place.

Singapore

In 2023, Singapore's Fintech Association unveiled its buy now, pay later code of conduct (BNPL code).

The BNPL Code sets out guidance for the industry to mitigate risks of consumer over-indebtedness,

ensuring that BNPL offerings will have a positive impact on Singaporean consumers, as well as to

continue to benefit the ecosystem. The BNPL Code crystallizes industry best practices such as

Buy Now, Pay Later (“BNPL”) Code of Conduct conducting creditworthiness assessments, ensuring fair and ethical marketing practices, accommodating for voluntary exemptions, and ensuring the provision of a hardship repayment plan, amongst others.

Mitigate BNPL Compliance Risk with PerformLine

With an omni-channel compliance monitoring solution that’s as agile as the BNPL regulatory environment, your organization can proactively avoid any potential compliance issues and quickly adapt its compliance program to new and emerging risks.

PerformLine’s omni-channel compliance monitoring solution provides:

- Comprehensive coverage of your organization and your merchants across marketing channels, including the web, calls, messages, emails, documents, and social media

- An adaptable compliance program that matches your risk threshold as you bring on new merchants

- Scalability as your merchant program grows, allowing your organization to bring on more merchants faster while ensuring compliance