Consumer Complaint and Compliance Trends for Bank-Fintech Partnerships

An analysis of consumer complaints submitted to the CFPB against banks & their fintech partners and the compliance risks they present

According to the CFPB, consumers’ complaints provide valuable information about the types of challenges consumers are experiencing in the marketplace and the effectiveness of an organization’s compliance management system.

By being aware of the types of issues that consumers are complaining about, organizations can use this information to shape their compliance programs to focus on the most pressing issues presenting risk to their business.

Here are the top consumer complaint trends that partner banks and their fintech partners should know to mitigate compliance risk.

Please note: The consumer complaint database does not have category filters to pull complaints specific to all partner banks and/or fintechs. To get these insights, we filtered complaints by selecting those submitted against known partner banks and fintechs.

Quick Stats

Before jumping into the complaint and compliance trends, here are some quick stats from a study conducted in 2021 on the growth of bank-fintech partnerships.

As the number of bank-fintech partnerships continues to grow, compliance risks increase significantly as there’s more potential for compliance issues across these partners (and their partners, too).

89% of banks consider fintech partners an important factor for growth as of 2021

65% of banks entered into fintech partnerships between 2019 and 2021

Banks’ average investment in fintech has grown 330% in 2021 from 2020

Banks that partner with fintechs average 2.5 partnerships per institution

10K complaints

Since January 2023, there have been over 10k complaints against fintech and partner banks in the CFPB’s Consumer Complaint Database.

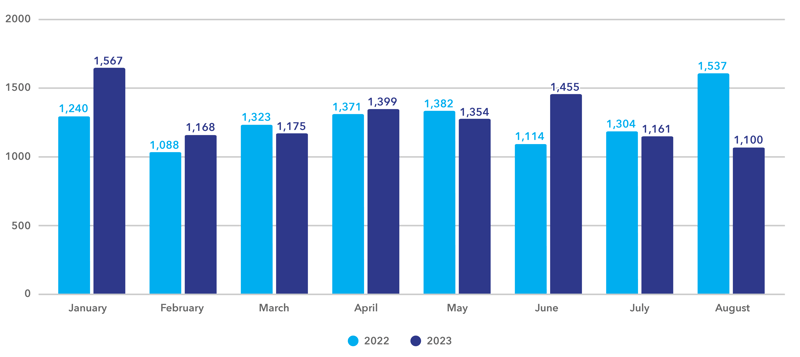

Total Bank Fintech Complaints

While total complaints vary month to month, total complaints submitted against fintechs and partner banks have increased 18% year over year.

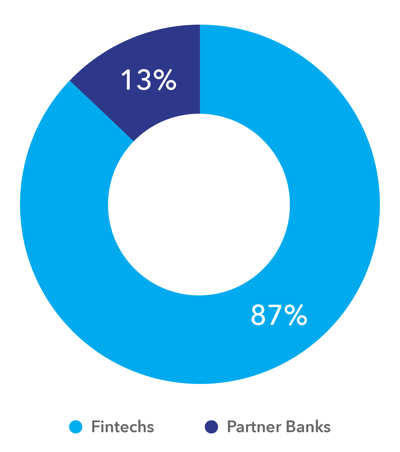

Share of Complaints: Fintech v. Partner Banks

87% of complaints in the CFPB’s database for banks and fintechs were made against the fintech brand, not the partner bank. Since the partner banks are typically “behind the scenes” of the transaction and the fintechs are consumer-facing, consumers are more likely to submit complaints against the fintech.

However, when the CFPB and other regulatory agencies investigate complaints against fintechs, they’ll also investigate the banks partnering with that fintech. Banks are expected to have vigorous oversight and ongoing monitoring of their fintech partners to ensure that they comply with regulations and meet consumer protection obligations. And now, banks are holding their fintech partners to a higher compliance standard as regulatory scrutiny of bank-fintech partnerships increase, according to American Banker.

Bank Fintech Complaints

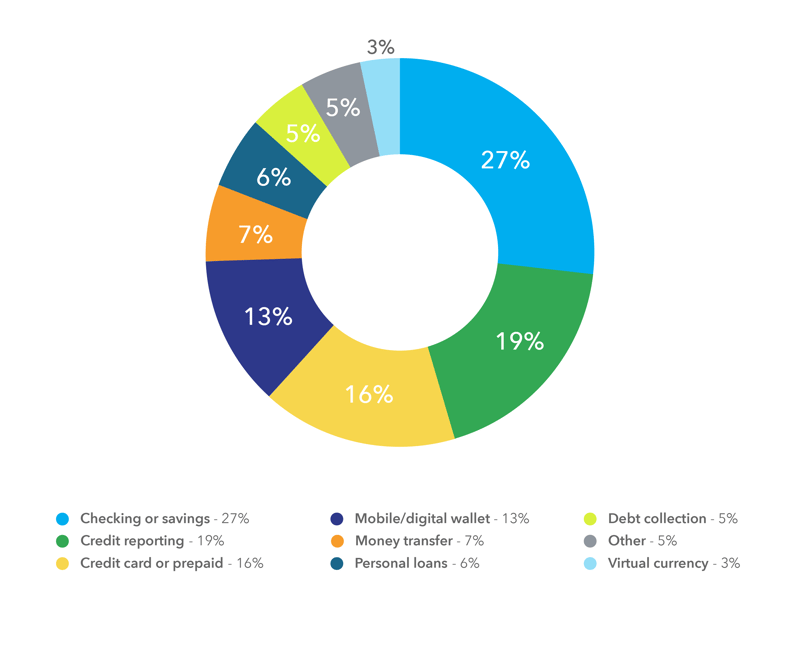

Bank Fintech Complaints by Product

The most complained about products specific to bank-fintech partnerships include checking and savings accounts (3,304), credit reporting (2,290), credit and prepaid cards (2,012), and mobile wallets (1,539).

Oversight of third-party partners should include ensuring that they’re in compliance with regulations for the specific product(s) and/or service(s) that are being offered, including those listed above.

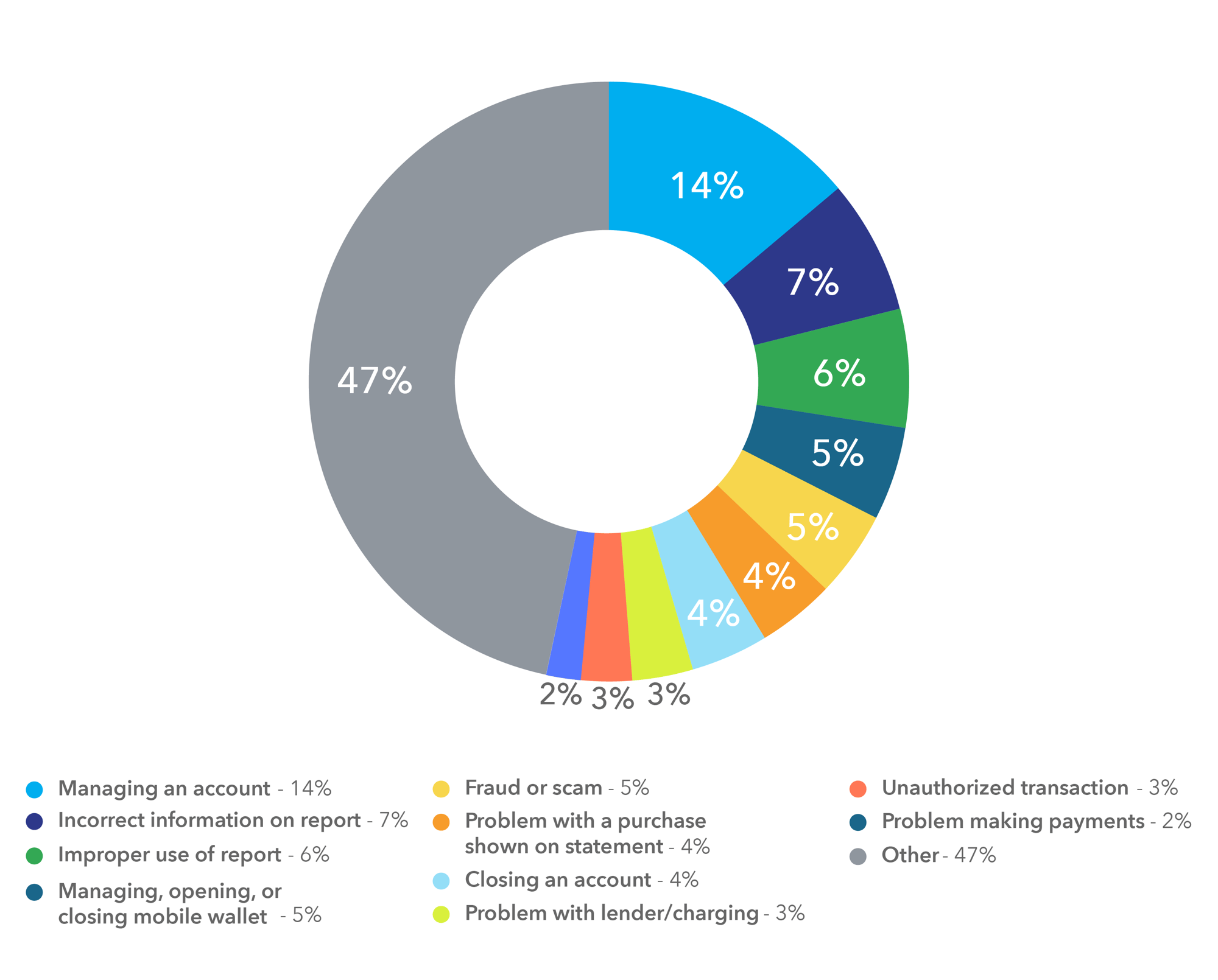

Bank Fintech Complaints by Issue

The most common issue that consumers face with partner banks and fintechs is managing their account, which most commonly includes deposits and withdrawals, problems using debit or ATM cards, trouble accessing accounts, funds not being handled or disbursed as instructed, banking errors, and problems making or receiving payments.

Key Takeaways for Your Organization

Importance of Comprehensive Oversight in Bank-Fintech Partnerships

With the surge in bank-fintech partnerships, the potential for compliance challenges increases exponentially. It's crucial for both partner banks and fintech partners to place a strong emphasis on robust compliance oversight and continuous monitoring of their operations across marketing channels.

Partner banks should closely monitor their fintech partners, and similarly, fintech entities should exercise diligent oversight of their affiliate partners to ensure adherence to regulations and protect consumers.

Collaborative Compliance Responsibility in the Bank-Fintech Partnership Ecosystem

Although a notable portion of complaints target fintech brands due to their direct consumer interactions, it's important to recognize that regulatory agencies investigating these concerns will also scrutinize the partner banks connected to these fintechs.

While partner banks bear primary accountability for compliance, fintechs should actively prioritize compliance efforts as well. Effective collaboration between partner banks and fintechs is crucial to promptly and effectively address and resolve consumer complaints, demonstrating a unified commitment to compliance excellence, and ultimately increasing consumer trust.

Mitigate Third-Party Compliance Risk with PerformLine

Having a compliance program that can grow and scale alongside your partnership program is a key component for getting out ahead of risk from the CFPB, the OCC, and other regulatory agencies.

PerformLine’s omni-channel compliance monitoring solution provides:

- Comprehensive coverage of your organization and your partners across marketing channels, including the web, calls, messages, emails, documents, and social media

- An adaptable compliance program that matches your risk threshold as you bring on new partners

- Scalability as your partner program grows, allowing your organization to bring on more partners faster while ensuring compliance

- A competitive advantage with a robust and proactive compliance management system