The Good, the Bad, and the Rules of Compliance for Loan Officers’ Social Posts

Ensuring regulatory and brand compliance has never been more important, or difficult, for mortgage lenders. Emerging marketing channels coupled with more loan officers to monitor and ever changing regulations has made compliance, especially across social media platforms, increasingly difficult.

We've broken it down with some real-life examples, the good, the bad, and what you need to monitor in your loan officers' social posts.

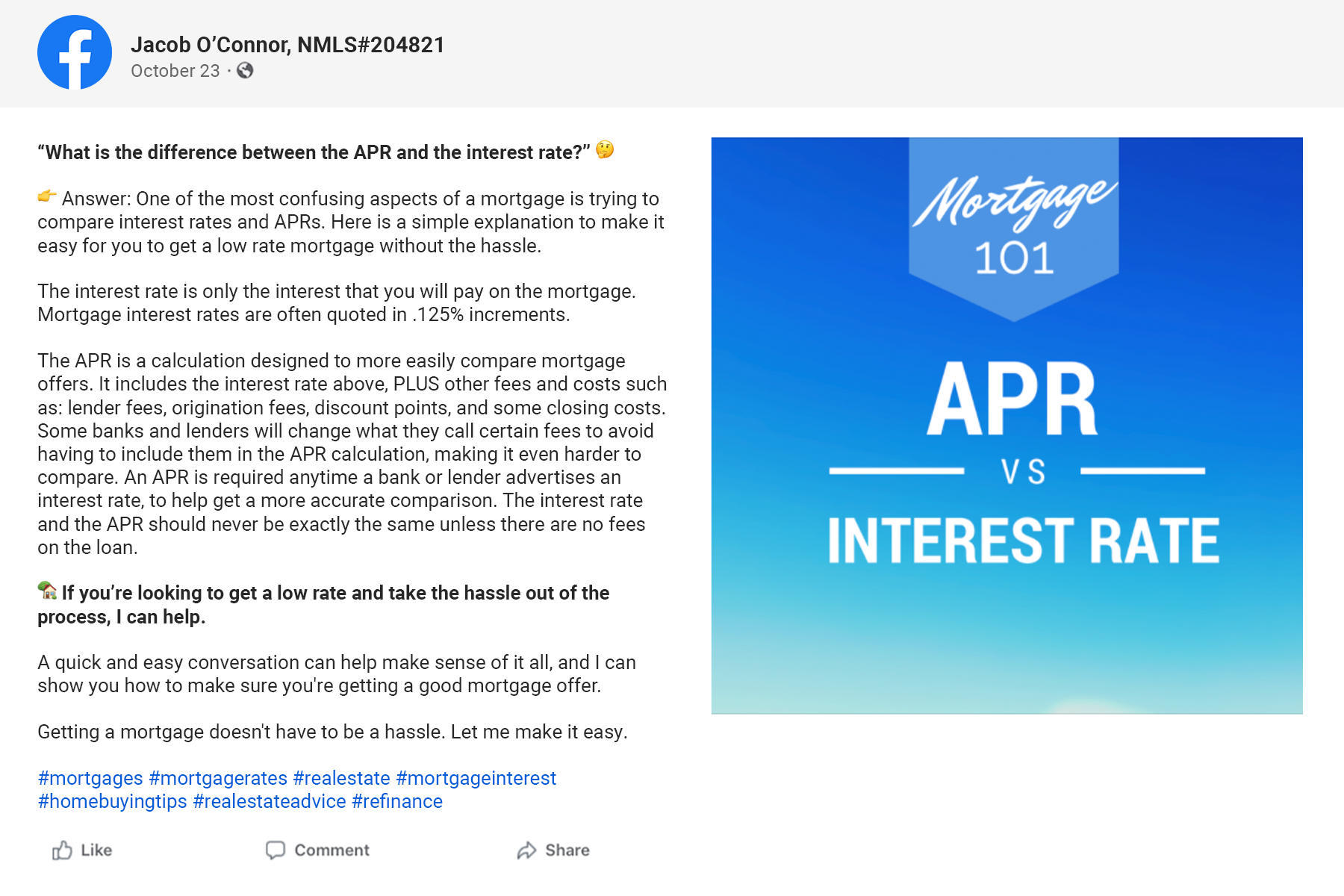

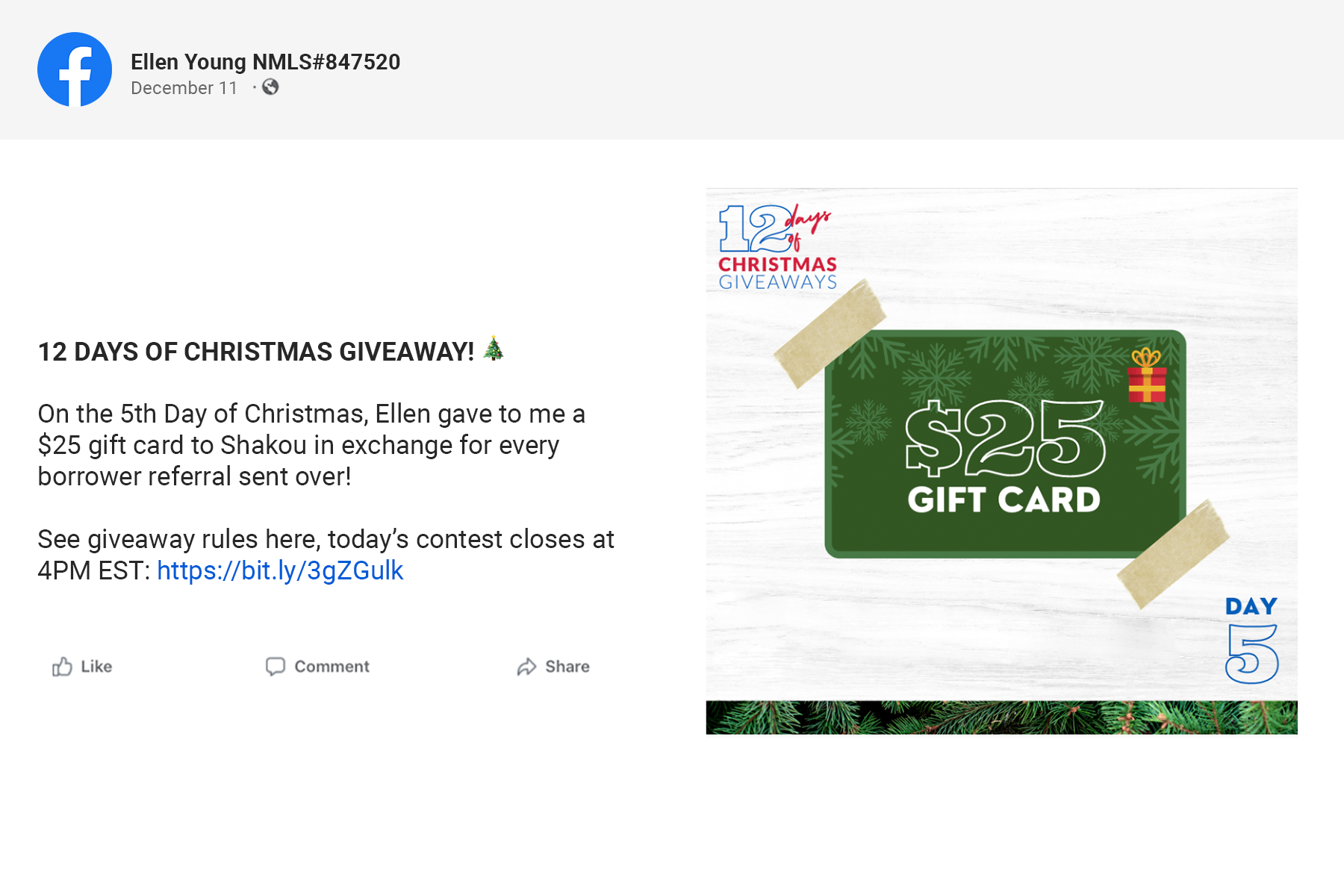

The Good

The below are great examples of compliant posts on social media from loan officers.

What makes them good?

- They clearly list the loan officers’ NMLS number and name

- If you were to click through to the loan officers’ Facebook pages their header images clearly lists the company names and NMLS numbers

- They have no direct mention of specific mortgage rates, but instead use helpful language to encourage personal conversations and discovery

- There are no inappropriate superlatives such as “the best,” “the lowest,” etc

- There is no abuse of urgency—neither post uses any language to suggest anything time-sensitive to the situation

- There doesn’t appear to be any offerings that have not been created or approved by the company

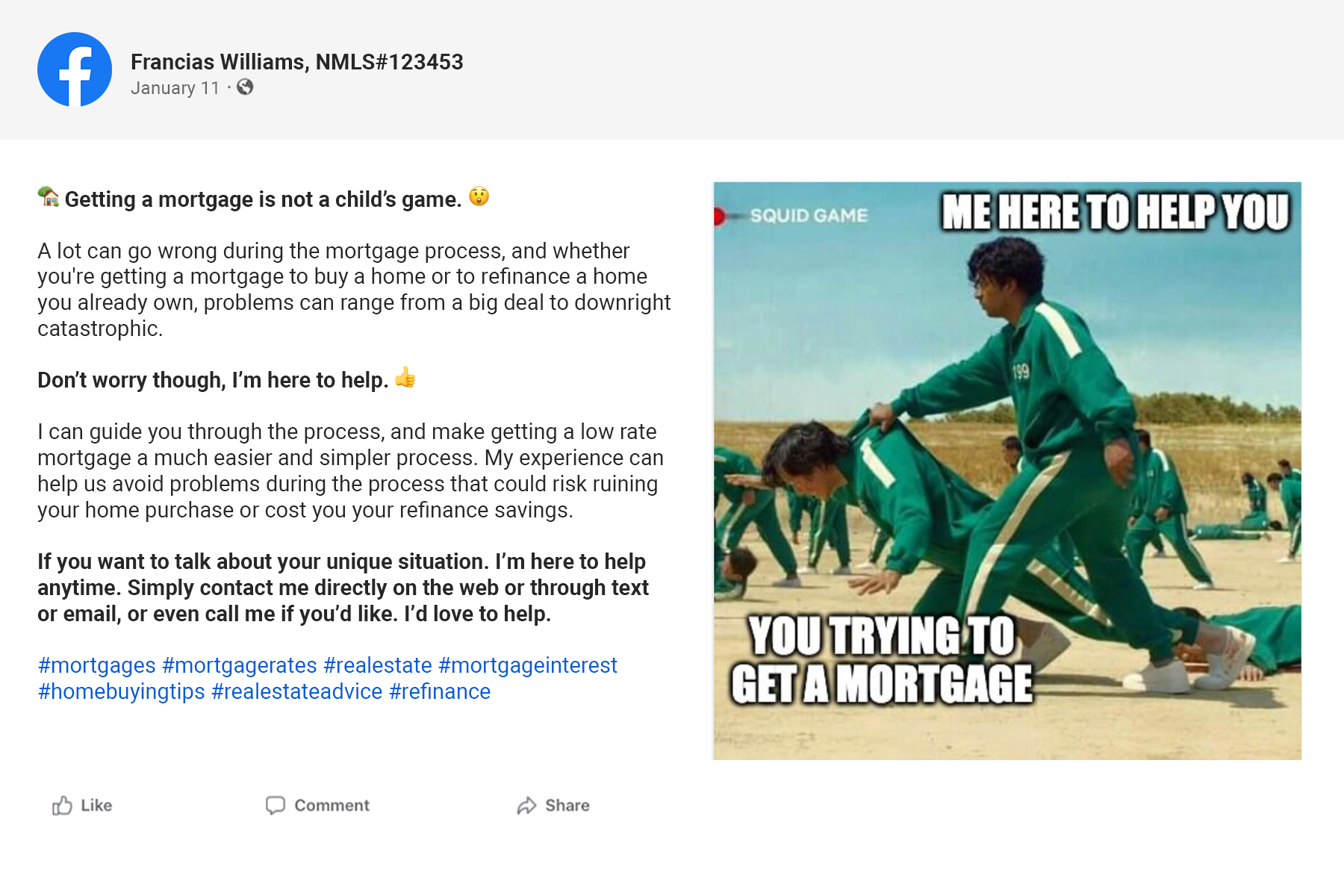

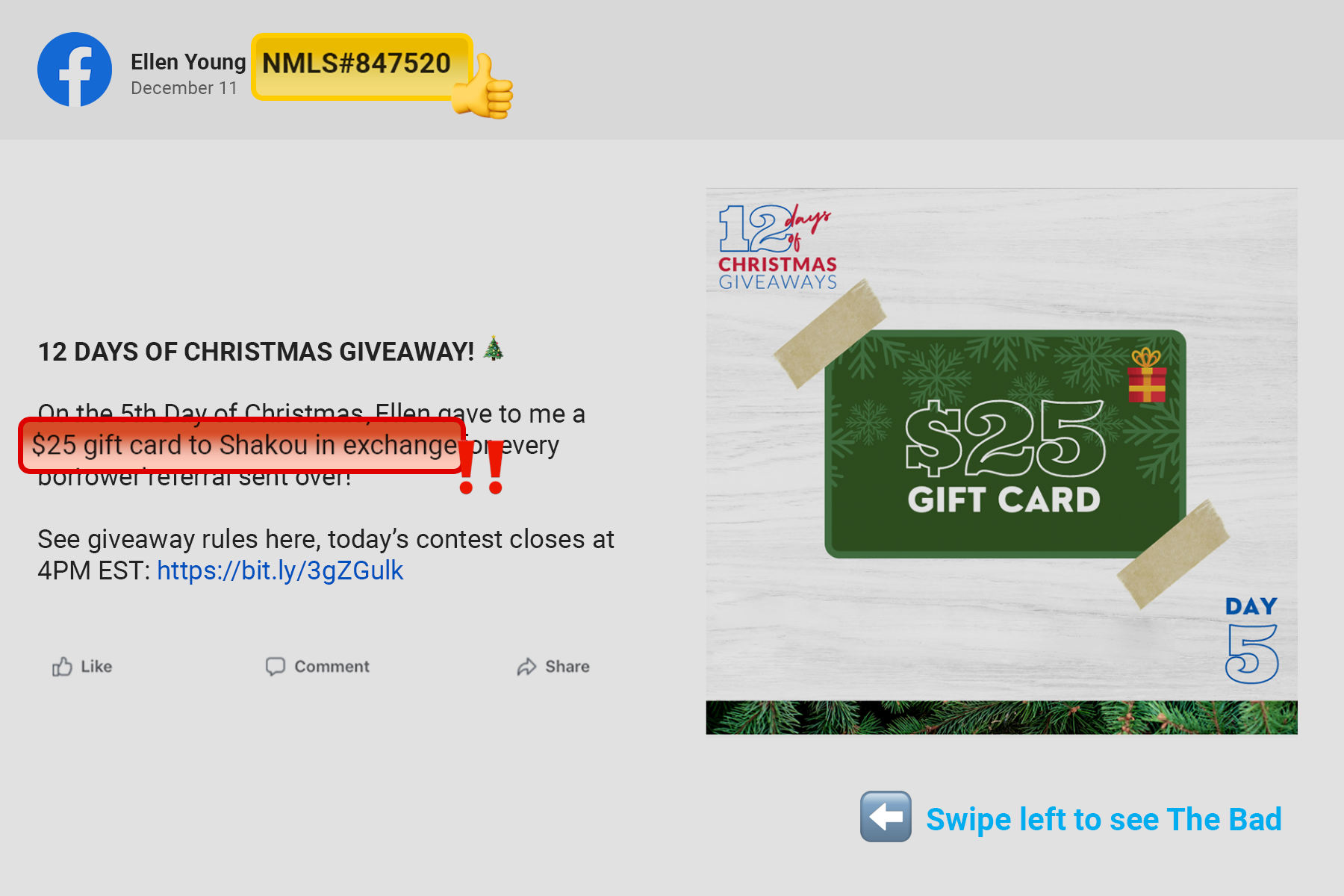

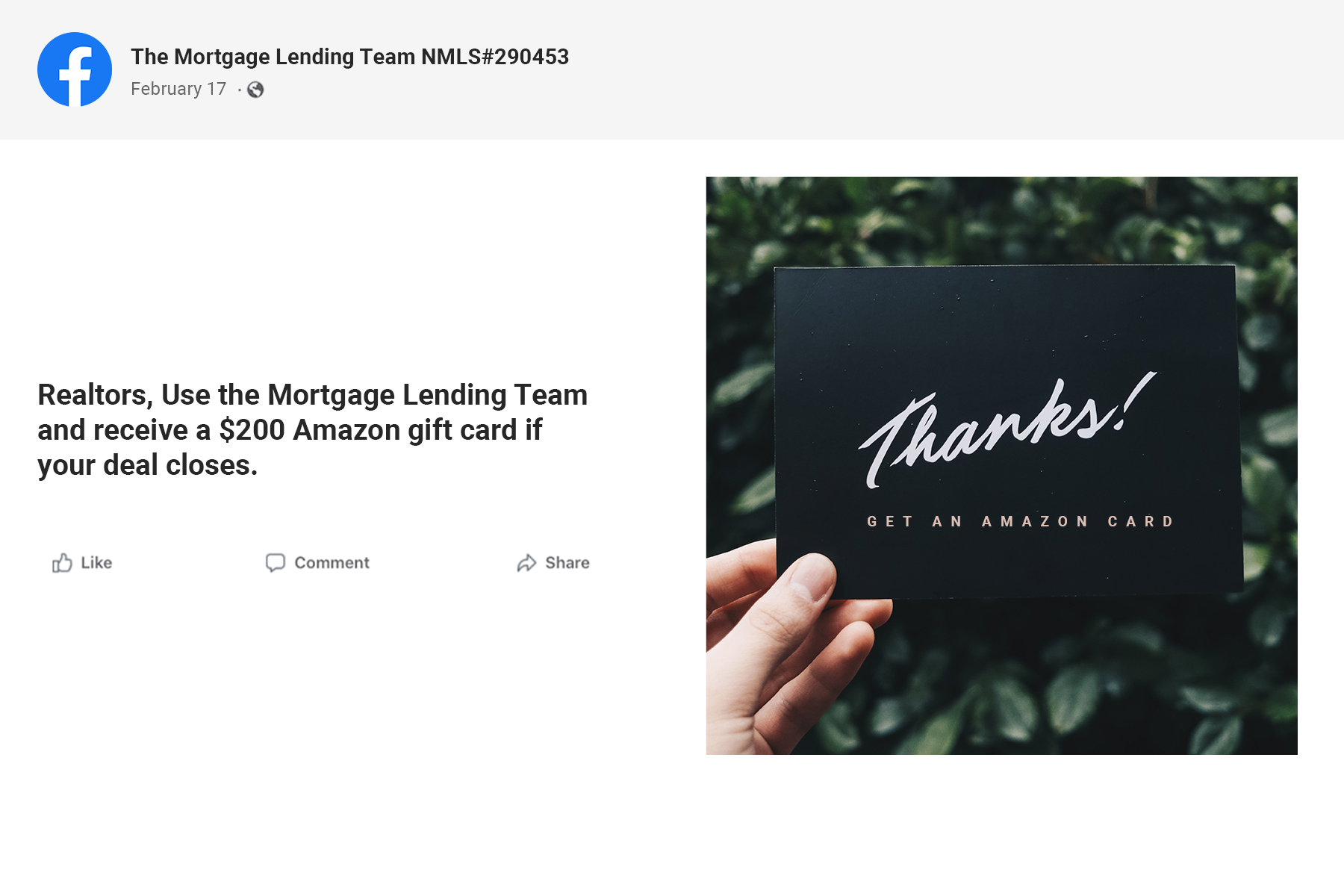

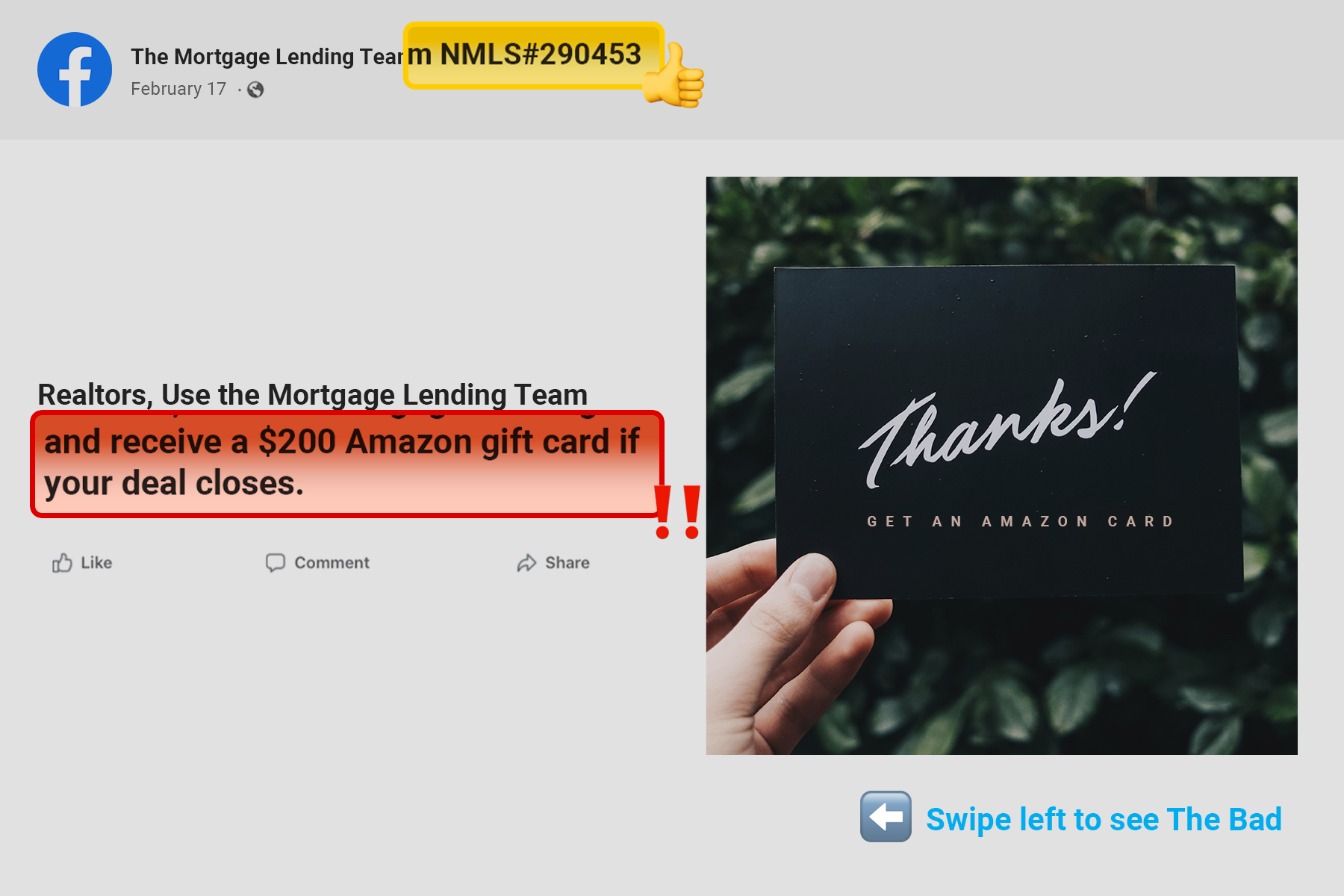

The Bad

The following are examples of social media posts that are not compliant.

What makes them bad?

It may be easy to miss these non-compliant posts during a manual review, especially since they both clearly list their NMLS numbers, but both of these examples contain RESPA violations.

RESPA requires all lenders and mortgage brokers to provide clear and complete information concerning real estate transactions and settlement services while meeting consumer protection laws on social media. The act also prohibits promoting fee-splitting, kickbacks, or exchanging something of value in order to acquire referrals or business through social media.

By offering gift cards in exchange for for referrals and business these loan officers could be violating RESPA regulations.

How Loan Officers’ Social Posts Can Stay Compliant

To help ensure your loan officers' social post don't end up on the “bad” list, you must implement a strong social media compliance program. Part of that includes clear training and requirements for mortgage lenders. Each mortgage lender has their own set of specific regulations when it comes to marketing and what must be included. Make sure that your loan officers are aware of each of these and include them where necessary.

- NMLS Number: The NMLS number (both personal and company) is required for loan officers in order for consumers to check up on their lenders. Lending officers must have this number available and easy to find on their profiles.

- NMLS Consumer Access Link: Consumers need to know where they can find information about their lenders, which is through the Consumer Access link. Require this to be included somewhere on your loan officer’s social profiles.

- Loan Officer’s Name on Personal Sites: Loan officers must disclose their name on their social media profiles as it is listed on the consumer access site, this validates their identity to consumers and provides complete transparency.

- Equal Housing Lender Statement: Institutions backed by the FDIC requires mortgage lenders to disclose themselves as an Equal Housing Lender or Equal Opportunity Lender. Be sure that loan officers have this somewhere on their profiles.

- Name of Parent Corporation: Loan officers should disclose their association with your company and point back to your company’s website.

Along with what's required in their postings, also include a list of what should not be included.

- Inaccurate or Outdated Mortgage Rate Information: All information about mortgage rates must be accurate and up-to-date and not be deceptive or misleading for consumers. The best practice here is to encourage your lenders to not list any rates on their social profiles, but link to a webpage with the most up-to-date information.

- Inappropriate Superlatives: The use of inappropriate superlatives, like claiming that rates are the “best” or “superior” for example, are prohibited.

- Urgency Abuse: Loan officers cannot use a false sense of urgency when communicating with consumers. This includes telling them that their rates will expire at a certain date, forcing or trying to influence them to make a quicker decision than necessary.

- Unknown Offerings: Loan officers should not make offerings to consumers that are not validated and approved by their organization.

Once these regulations are clearly documented, regular internal compliance trainings should be held to ensure all loan officers remain compliant across their social media channels and to keep them up-to-date on evolving social media regulations.

Learn more about social media compliance for loan officers here.

Monitor all your loan officers' social posts, all the time

PerformLine automates the monitoring of social accounts by loan officers, including TikTok, Twitter, LinkedIn, Facebook, Instagram, and YouTube.

Our technology discovers and monitors content and pages owned by your loan officers and identifies and scores potential regulatory compliance violations or brand marketing abuses for remediation, as well as discovers unapproved social accounts marketing on behalf of their organization.