Top 4 Compliance Issues for Personal Loan Products

PerformLine monitors thousands of pieces of published content daily for compliance using proprietary technology and expert rulebooks to look for potential violations.

This study was conducted over a 6-month period reviewing thousands of web pages and social media posts for personal loan offerings.

Here are the top four remediated terms and categories that companies use to ensure that loan products are being promoted accurately across known (and unknown) places across the web and social media.

Findings: The Best | Outdated APR | Credit Deception | Payday

#4 - THE BEST

The fourth most commonly remediated term for personal loans is “the best.”

Using phrases like “the best” implies that the product being marketed is superior to all other products in the market.

However, there is no objective way to determine what is "the best,” as what is considered the best for one person may not be the best for another and is based on an individual’s unique needs and situations.

#3 - OUTDATED APR

The fourth most commonly remediated term for personal loans is “the best.”

Using phrases like “the best” implies that the product being marketed is superior to all other products in the market.

However, there is no objective way to determine what is "the best,” as what is considered the best for one person may not be the best for another and is based on an individual’s unique needs and situations.

#2 - CREDIT DECEPTION

The second most commonly remediated category for personal loans is credit deception, which in this case, flags a list of terms in proximity to the word "credit" that could be potentially misleading.

Terms here include “credit rating,” “help your credit,” “bad credit,” and “repair credit.” While some products may actually help repair and improve credit, that may not be the case for every consumer, which could lead to potential UDAAP issues.

#1 - PAYDAY

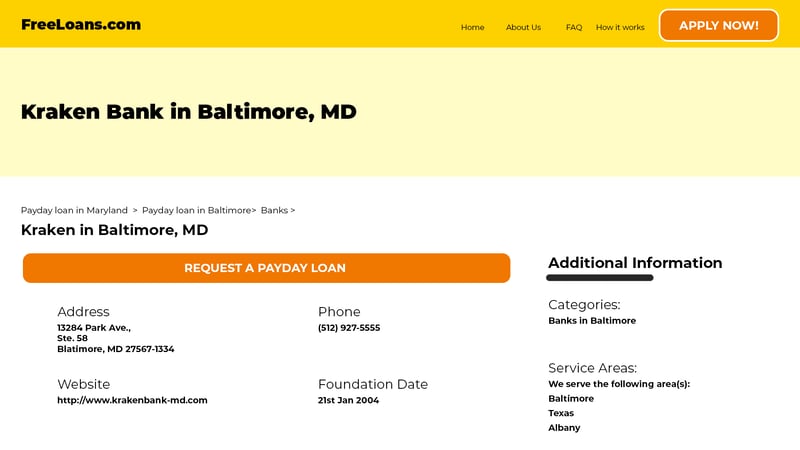

The top most remediated compliance term for personal loans is “payday.”

In this context, we’ve seen instances where external entities use brand names to falsely promote certain products or services as “payday” loans, quick cash, instant money, etc. and encourage consumers to apply for a loan. The consumer thinks they’re applying for a product from a certain company, but instead, they’re giving their information to a fraudulent third party that has no relation to the brand that they are promoting.

In this example, the call-to-action “request a payday loan” does not bring the consumer to the company’s website.

A company is responsible for monitoring all places in which its brand is being promoted (both known and unknown), whether or not third parties are involved.

Need help ensuring compliance across marketing materials?

With PerformLine, your organization can gain complete oversight for your organization with comprehensive regulatory and brand monitoring across your marketing and partner channels.

PerformLine’s omni-channel solution was built to automate the discovery and monitoring of potential regulatory and brand compliance violations on all marketing channels, including the web and social media, as well as calls, messages, emails, and documents. Our turn-key industry rulebooks are built on years of experience working with regulators and industry clients.