Top Fintech Partner Compliance Issues for Banking-as-a-Service Banks + Providers

PerformLine monitors thousands of pieces of published content daily for compliance using proprietary technology and expert rulebooks to look for potential violations.

The top compliance issues for banking-as-a-service banks and providers are dependent on the products and/or services that fintech partners are offering.

What product(s) do your fintech partner(s) offer to consumers? Click the (+) to see the top compliance issues for that product or service.

#5 - Instant Approval

The fifth most commonly monitored and remediated term(s) for BNPL products were “instant approval” and ”instant financing.” These terms essentially boil down to two main compliance concerns.

The first concern is that almost no one can promise approval for consumers without first looking at their financial situation, whether it’s instant or not. There are a number of different factors that are considered when it comes to approval, and organizations cannot mislead consumers by guaranteeing approval without prior analysis of their financial data.

The second concern is that the term “instant” is typically interpreted by consumers to mean within seconds or minutes. In many cases, approval can take anywhere from a few hours to a few business days.

Instead, many clients instruct their merchants and partners to replace language like “instant approval” or “instant financing” with phrases such as “instant decision” or “instant loan decisioning.” This way, consumers won’t be misled into thinking that they’ll get approval no matter what and level sets their expectations.

#4 - Affordable

The fourth most commonly flagged term for BNPL products is “affordable.”

The term “affordable” may create unrealistic expectations for the consumer because what’s affordable for some may not be for others. What’s considered “affordable” is highly subjective and can vary depending on the consumer's financial situation, so using this term without clear context or qualifications can be misleading.

#3 - Credit

The third most commonly remediated terms discovered during the study were rules associated with “credit.” The usage of a credit check prior to purchase from these BNPL companies varies, but it’s critical that whatever their credit process is, it’s clearly documented. Hence why some of the top remediate phrases in this category are “no credit check” and “no credit needed.”

The other primarily banned rule in this category has to do with the distinction between a BNPL and credit card purchase. The BNPL industry cannot mislead consumers that this type of purchasing will improve credit scores or act as a credit card if that’s not actually the case. An example of banned terminology in this category includes “credit card” or “build your credit.”

#2 - Disclosures

The second most remediated category for BNPL products is outdated or missing lending disclosures across merchant websites. Specifically, the top flagged disclosures in this category were for annual percentage rates (APR) and missing issuer information.

Merchants must update available APR associated with the BNPL product that they’re offering and include a disclosure around "based on credit" and/or "subject to approval." Depending on the type of loan, merchants may also be required to disclose which bank is issuing the funds or loans.

#1 - Finance/Financing

The most commonly remediated terms discovered during the study were rules associated with financing language.

Many BNPL companies that focus on leasing products (as opposed to selling) have banned the term “finance” or phrases such as “credit financing” from all materials. As with all leased-to-own products, the consumer is not the owner of the product until the end of the agreement.

So, while many of these companies offer lease or rental agreements, they do not offer financing or loans and require this terminology to be banned from all materials.

#4 - Outdated APR

The fourth most remediated category for credit cards is outdated APRs.

Under the Truth in Lending Act (TILA), lenders are required to disclose the APR accurately and uniformly in all of their marketing materials, including advertisements, application forms, and credit agreements.

Similarly, the Credit Card Accountability Responsibility and Disclosure Act (CARD Act) requires credit card issuers to provide clear and conspicuous disclosures of credit card terms and fees, including APRs.

Since APRs are a key factor for consumers to determine the cost of credit and help them compare credit products, an inaccurate APR rate can be deceptive and harm consumers.

#3 - No Interest

The third most remediated term for credit cards is the term “no interest.” This term could be considered deceptive or misleading if the offer is not truly interest-free.

For example, issuers often run promotional periods during which no interest is charged on purchases or balance transfers, but after the promotional period ends, interest charges will apply. In this case, if a credit card issuer advertises "no interest" without disclosing the specific terms and conditions of the promotion, it could be viewed as a violation of truth in advertising laws or consumer protection regulations.

#2 - Instant/Automatic Approval

The second most commonly remediated terms for credit cards are those around “instant” or “automatic” approvals.

These terms essentially boil down to two main compliance concerns.

The first concern is that almost no one can promise approval for consumers without first looking at their financial situation, whether it’s instant or not. There are a number of different factors that are considered when it comes to approval, and organizations cannot mislead consumers by guaranteeing approval without prior analysis of their financial decisions.

The second concern is that the terms “instant” and “automatic” are typically interpreted by consumers to mean within seconds or minutes. In many cases, approval can take anywhere from a few hours to a few business days.

Instead, many clients instruct their merchants to replace language like “instant approval” or “instant financing” with phrases such as “instant decision” or “instant loan decisioning.” This way, consumers won’t be misled into thinking that they’ll get approval no matter what and level sets their expectations.

#1 - Missing Issuer Name

The number one most commonly flagged and remediated violation for credit cards was missing issuer name.

Regulation Z requires credit card issuers to disclose certain information to consumers, including the name of the creditor or issuer. Specifically, TILA requires that credit card solicitations and applications prominently display the name of the creditor or issuer, along with other information such as the APR, fees, and other important terms.

#4 - The Best

The fourth most commonly remediated term for personal loans is “the best.”

Using phrases like “the best” implies that the product being marketed is superior to all other products in the market. However, there is no objective way to determine what is "the best,” as what is considered the best for one person may not be the best for another and is based on an individual’s unique needs and situations.

#3 - Outdated APR

The third most remediated category for personal loans is outdated APRs.

Under the Truth in Lending Act (TILA), lenders are required to disclose the APR accurately and uniformly in all of their marketing materials, including advertisements, application forms, and credit agreements.

Since APRs are a key factor for consumers to determine the cost of credit and help them compare loan products, an inaccurate APR rate can be deceptive and harm consumers.

#2 - Credit Deception

The second most commonly remediated category for personal loans is credit deception, which in this case, flags a list of terms in proximity to the word "credit" that could be potentially misleading.

Terms here include “credit rating,” “help your credit,” “bad credit,” and “repair credit.” While some products may actually help repair and improve credit, that may not be the case for every consumer, which could lead to potential UDAAP issues.

#1 - Payday

The top most remediated compliance term for personal loans is “payday.”

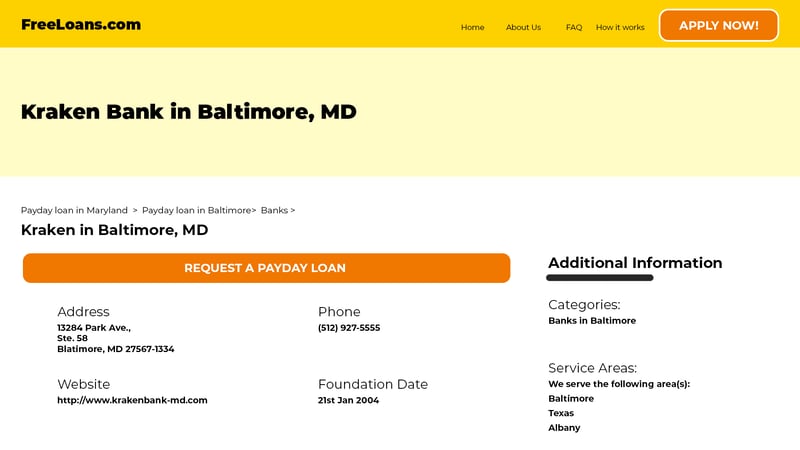

In this context, we’ve seen instances where external entities use brand names to falsely promote certain products or services as “payday” loans, quick cash, instant money, etc. and encourage consumers to apply for a loan. The consumer thinks they’re applying for a product from a certain company, but instead, they’re giving their information to a fraudulent third party that has no relation to the brand that they are promoting.

In this example, the call-to-action “request a payday loan” does not bring the consumer to the company’s website.

A company is responsible for monitoring all places in which its brand is being promoted (both known and unknown), whether or not third parties are involved.

#4 - Company Name

The fourth most monitored and remediated category for mortgage products is company names.

It’s important that consumers know who is attempting to get their business, therefore mortgage companies should include their company name on their advertisements and it should be listed in a clear and conspicuous manner.

#3 - Corporate Domain

The third most commonly remediated category is corporate domains.

Many organizations monitor for their corporate domain across the web to discover vanity URLs that loan officers create independently, or manage without the consent or approval of the organization.

If they are creating vanity URLs that you are not aware of, you don’t have control over the content and the site may be in violation of regulations. This can put your company’s brand at risk and could result in action against the loan originator.

#2 - Corporate NMLS ID

The second most monitored and remediated term for mortgage products is the NMLS IDs. Similar to company names, organizations are required to include their NMLS identifier on loan documents and advertisements, and it should be listed in a clear and conspicuous manner. issues.

#1 - Equal Housing Opportunity / Equal Housing Lender

The top most remediated category for mortgage products is the Equal Housing Opportunity/Equal Housing Lender logo and/or statement.

When offering and promoting loan products, organizations are required to include the Equal Housing Lender or Equal Housing Opportunity logo or statement in some capacity, whether on the image itself, or included somewhere on the profile.

No matter what products your fintech partners offer, PerformLine’s got you covered.

Your fintech partners are offering a wide variety of products and services that all have unique sets of regulations and guidelines, which can make compliance oversight daunting.

With PerformLine’s omni-channel compliance monitoring solution, you get one platform to monitor six marketing channels for unlimited fintech partners across various consumer finance industries.

PerformLine has over 15 years of experience working with clients across all forms of consumer finance, packaged into robust, ready-to-use rulebooks to deploy across your industry-segmented fintech network and across your marketing channels.