8 UDAAP Marketing Compliance Violation Examples to Show Your Team

Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) is a hot topic in the consumer finance industry, especially when it comes to marketing materials—but what do UDAAP violations actually look like in marketing materials?

We've compiled a list of 8 real examples of UDAAP violations that you can show your team to help them understand what UDAAP looks like in practice to proactively get out ahead of potential issues.

Move the sliders to the left to reveal the UDAAP violation!

Example #1

What's wrong with this marketing material?

This is an example of an exaggerated claim. Exaggerated claims in marketing materials for financial products refer to statements that are not entirely truthful or accurate and are designed to make the product or service appear more attractive or valuable than it actually is.

This website offers consumers a “free” credit report—but, they require the customer to sign up for a credit monitoring service with a monthly fee, making the report not actually free. This web page doesn’t clearly disclose that disclosure, which may deceptively lead to a consumer signing up without fully understanding the associated fees.

Example #2

What's wrong with this marketing material?

This is another example of an exaggerated claim.

This bank is offering a checking account with “no fees,” which is partially true—they don’t charge maintenance fees for their checking accounts. However, there are still fees with other services, such as overdrafts, stop payments, or wire transfers. As a result, consumers may reasonably believe that they will not incur any fees when using the checking account based on the marketing materials, which isn’t entirely true.

Example #3

What's wrong with this marketing material?

This is an example of subjective language. Subjective language is terms or phrases that are open to interpretation or opinion, can be vague or ambiguous, and do not have a clear or objective meaning.

This webpage is promoting its credit card as "the best" without any sort of substantiation or disclaimers, which is misleading because what’s best for one consumer might not be what’s best for another. This message also creates a false sense of superiority, which can pressure consumers into applying for the credit card without fully considering their options.

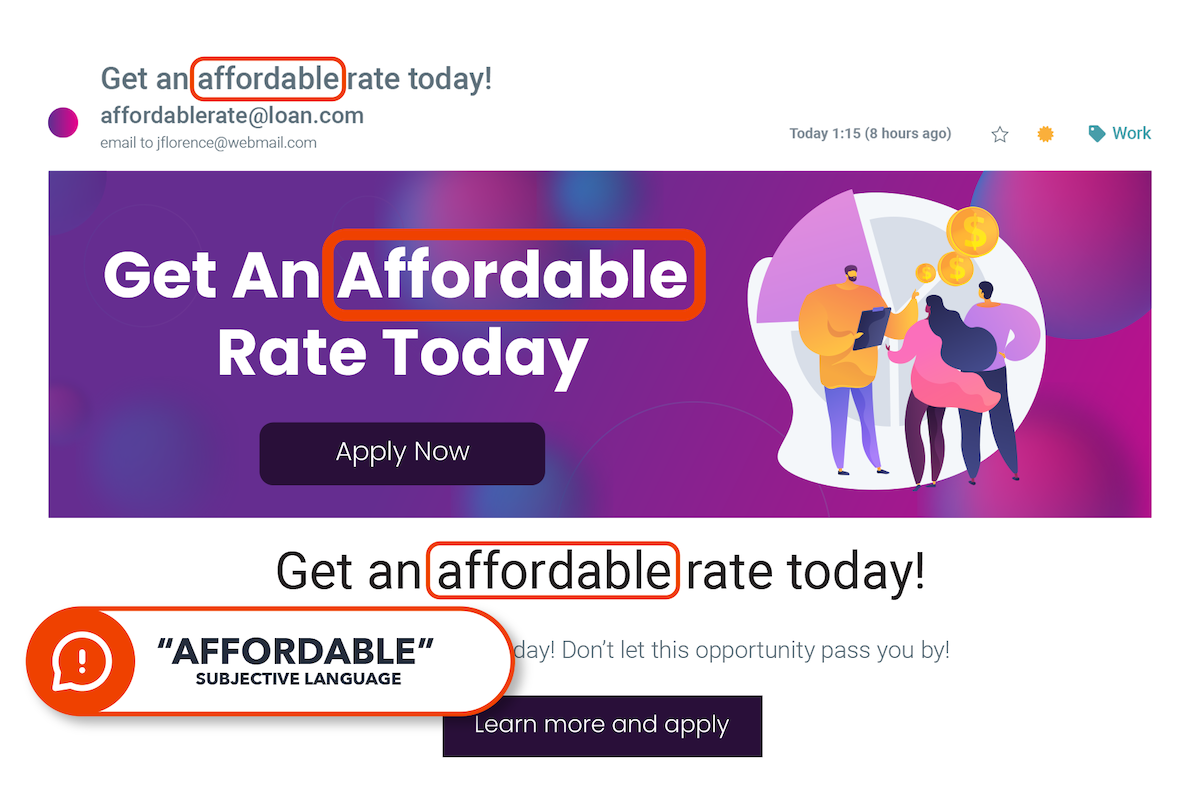

Example #4

What's wrong with this marketing material?

This is another example of subjective language.

In this example, the email doesn’t provide context for what’s considered “affordable” or how the rate compares to other rates in the market, which could be misleading and give consumers an inaccurate impression of the actual cost of the product.

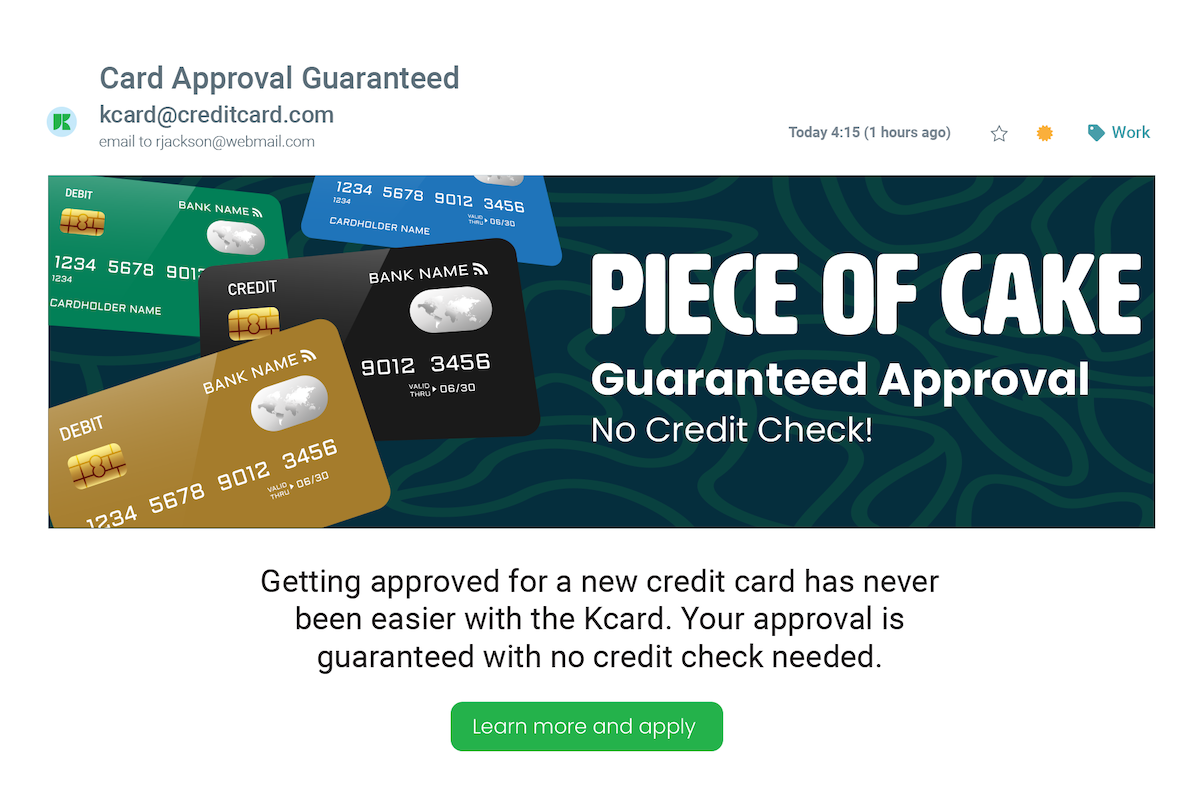

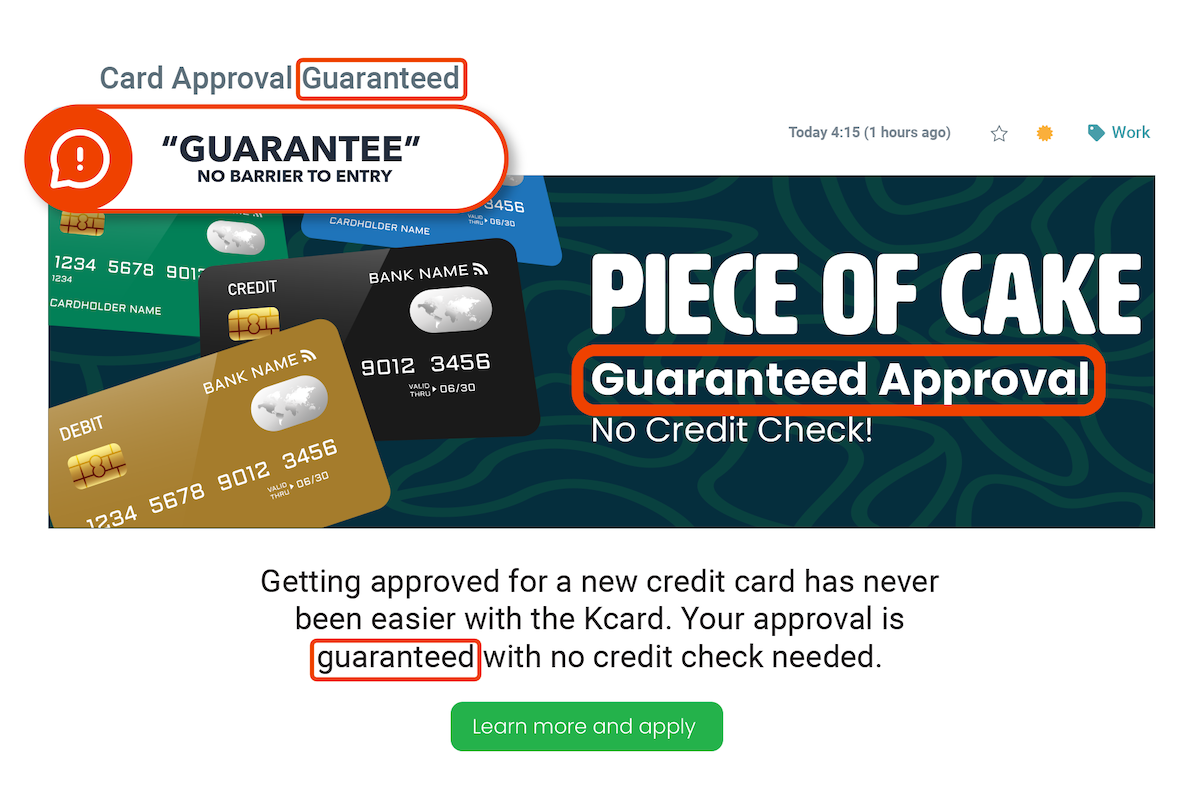

Example #5

What's wrong with this marketing material?

This is an example of "no barrier to entry" claim, which are statements or descriptions that imply that there are no obstacles or requirements for consumers to obtain or get approved for a particular financial product or service.

This email offers consumers guaranteed approval, but there are additional requirements and qualifications that have to be met before approval is actually guaranteed. If consumers are led to believe that they will be approved without question, but are later denied or subject to additional conditions, this can be considered a deceptive practice.

Example #6

What's wrong with this marketing material?

This is another example of "no barrier to entry" claim.

In this example, the flyer promises consumers instant approval, but approval is actually based on the consumer’s credit history and can take anywhere from 2 to 5 days. Since the language on the flyer would reasonably lead a consumer to believe that they would get approved instantly, this could be considered a UDAAP violation.

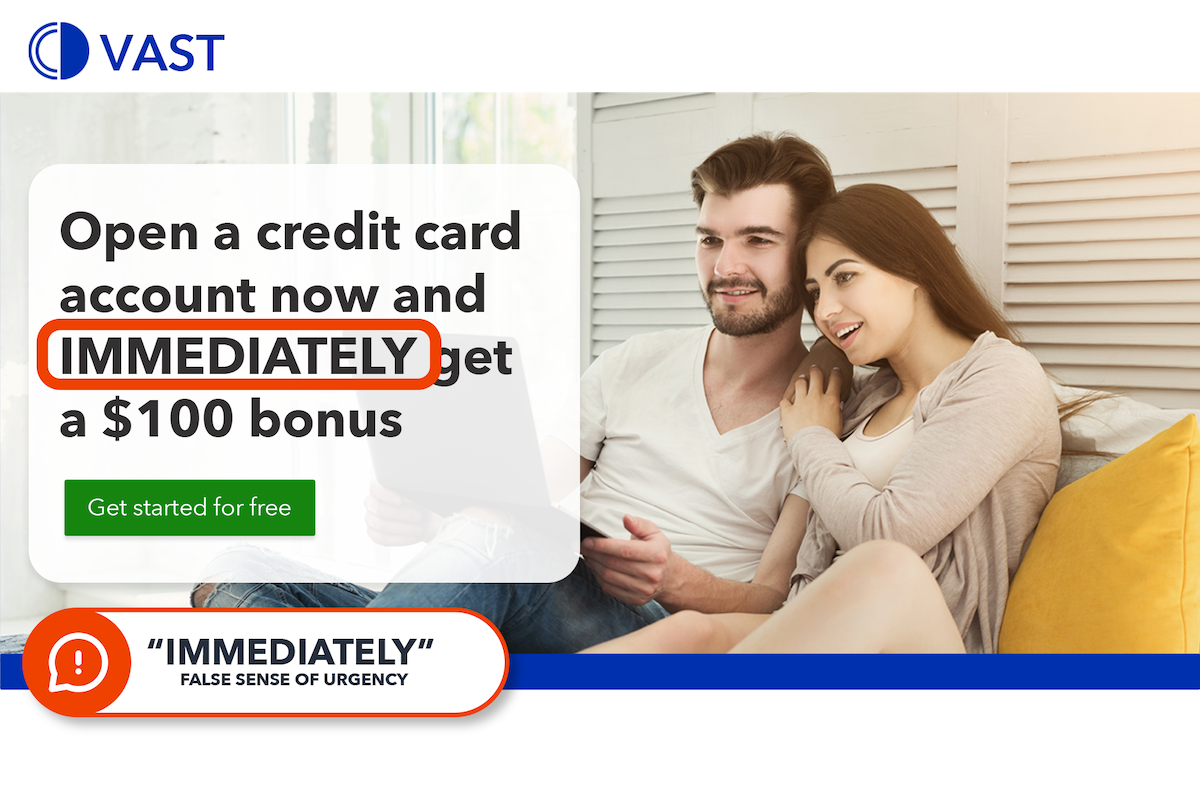

Example #7

What's wrong with this marketing material?

This is an example of a false sense of urgency tactic that creates unrealistic expectations for consumers on how quickly they can get approval or access to a specific product.

In this example, the language used may create a false sense of urgency for and pressure on the consumer to make a quick decision, without considering the long-term consequences of opening a new credit card account. By offering an immediate $100 bonus, the marketing material encourages the consumer to focus on the short-term gain rather than the long-term costs and benefits of the credit card.

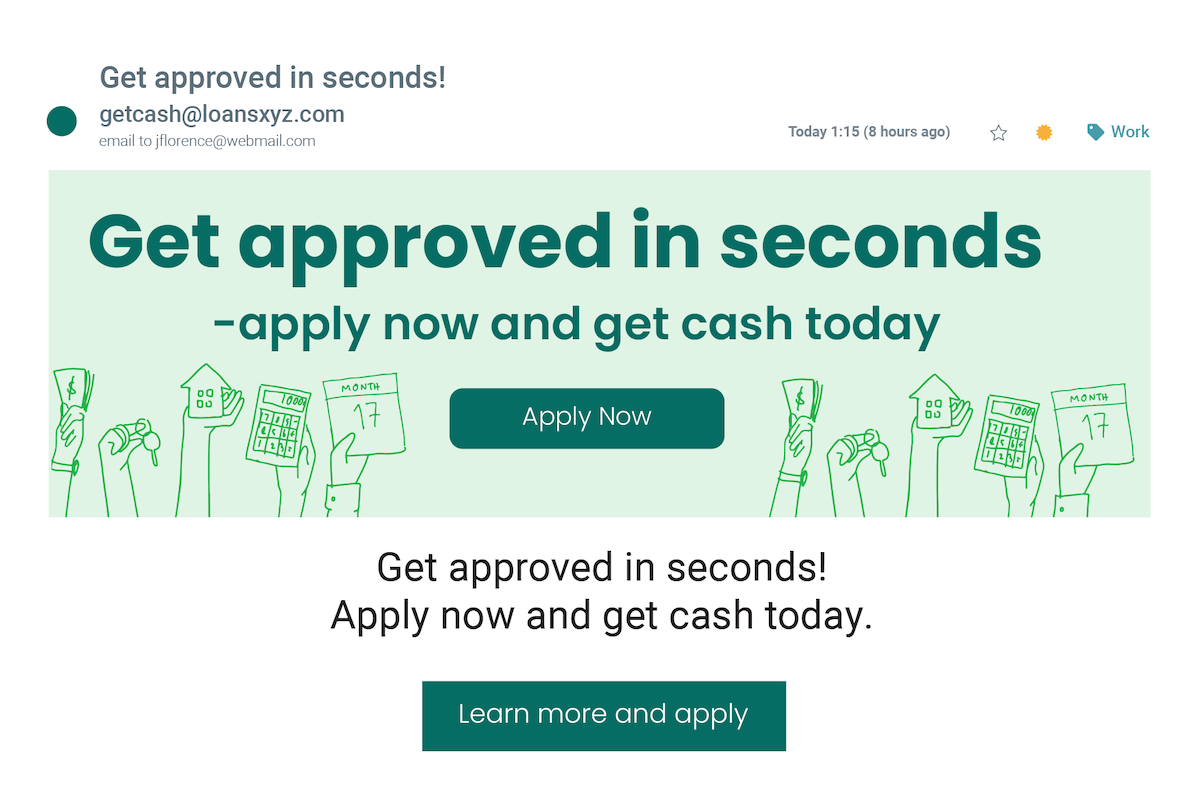

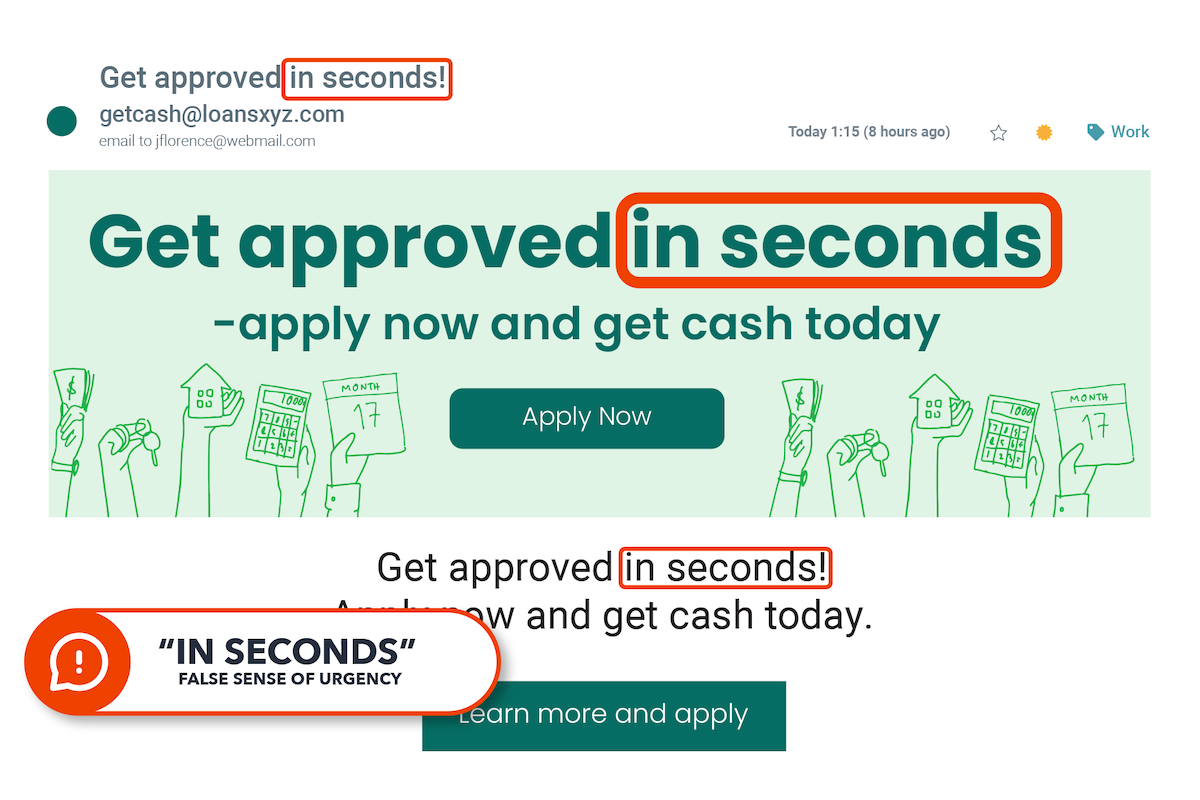

Example #8

What's wrong with this marketing material?

This is another example of a false sense of urgency tactic. Different from Example #7, this example creates unrealistic expectations for consumers on how quickly they can get approval or access to a specific product.

The language used suggests that the loan application process is extremely fast and easy and that the consumer can receive cash the same day they apply. But, in reality, the loan application process involves several steps, including filling out an application, providing documentation, and waiting for the lender to review and approve the application—which takes much longer than “seconds.”

Looking for visibility into your marketing materials for UDAAP compliance?

With PerformLine, you can rest peacefully knowing that our always-on compliance platform is continually monitoring your marketing channels to catch potential UDAAP violations in real time so you can quickly remediate issues, mitigate risk, and protect your brand.

Learn more about how PerformLine can help your company proactively identify and mitigate UDAAP compliance risk across marketing channels before they become a bigger issue.

Schedule a demo with our team today.