Consumer Complaints, Enforcement Actions, and Compliance Trends from the CFPB

An analysis of consumer complaints submitted to the CFPB, the enforcement actions that come from them, and the compliance risks they present

PerformLine’s Complaint Risk Signal Report takes a deep dive into consumer complaint and enforcement action data collected from the CFPB’s Consumer Complaint Database to highlight key trends, present notable observations, and provide actionable takeaways.

Here are the top consumer complaint trends that consumer finance companies should know to mitigate compliance risk.

Total Complaints Submitted by Year

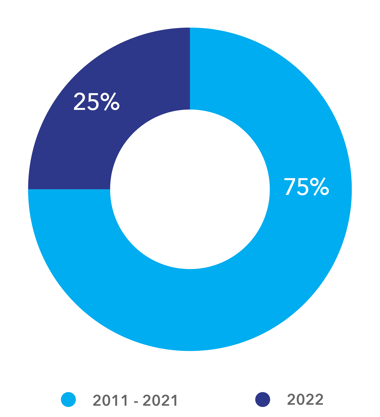

CFPB Complaints: 2022 v. Total

Consumers submitted over 800,000 complaints in 2022—a record-breaking number that rose by 80% compared to the previous year. Notably, these complaints account for nearly one-fourth (25%) of all complaints received by the CFPB since its establishment in 2011.

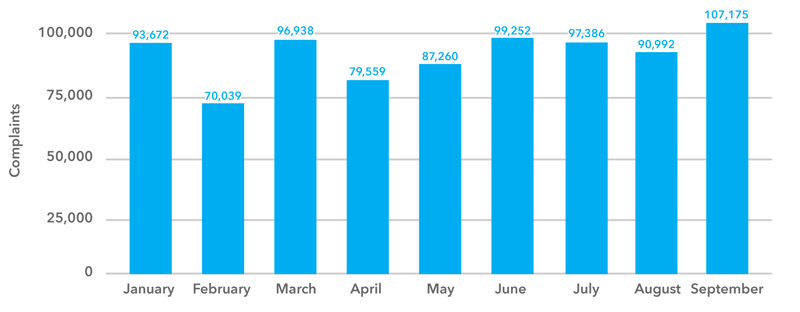

Total Complaints MoM

Consumer complaints have surpassed 798k in 2023—a 60% increase from the same time period in 2022.

Since its creation, the CFPB has taken:

322

Public Enforcement Actions

$13.5B

in Consumer Relief

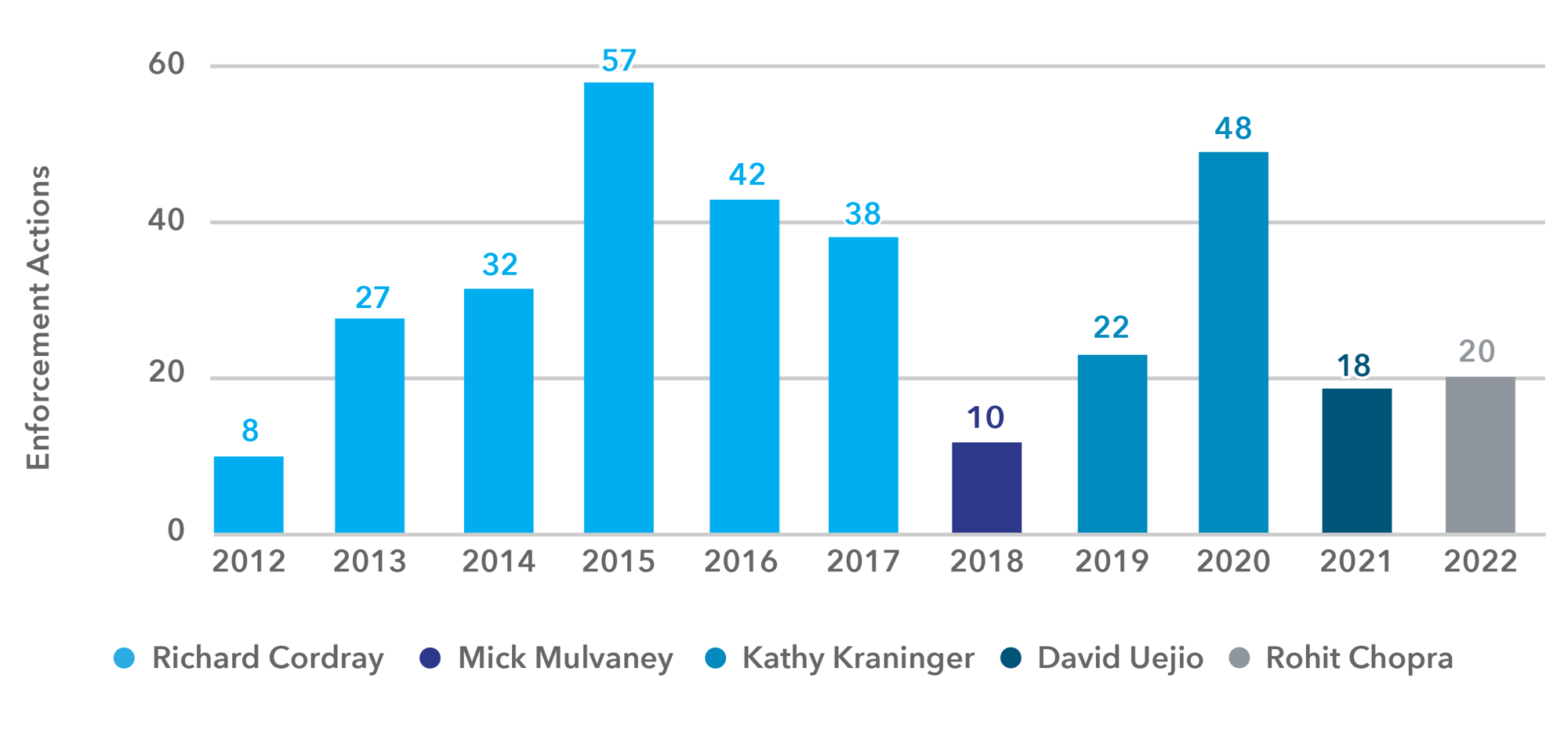

Count Enforcement Actions by Year

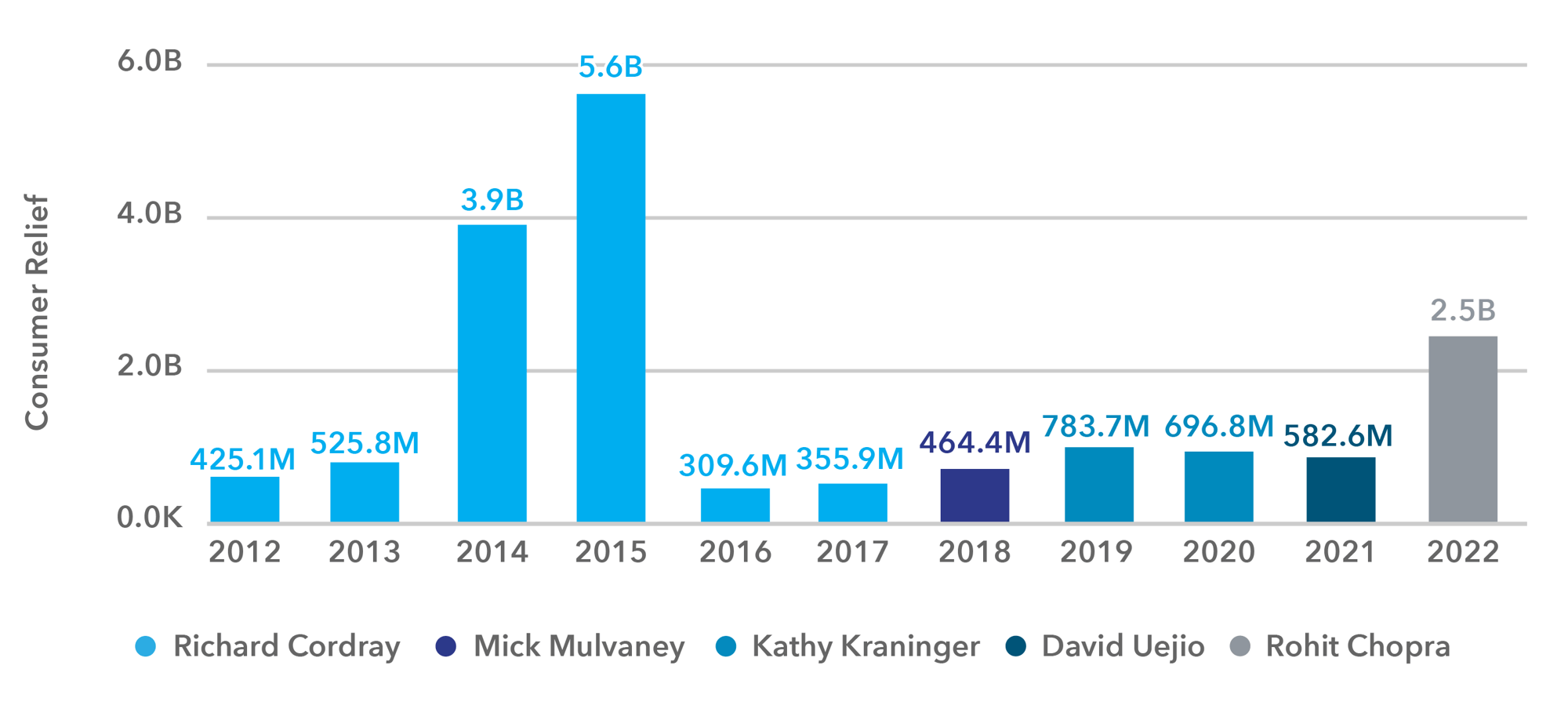

Consumer Relief by Year

While the number of enforcement actions decreased in recent years, consumer relief saw a significant increase in 2022. The data suggests that although fewer actions were taken, the focus shifted towards providing more substantial monetary compensation to affected consumers.

However, fewer public enforcement actions doesn’t mean an inactive CFPB.

“I don’t think the numbers tell the whole story here. From what we’ve seen, there's a huge number of non-public supervisory activity occurring behind the scenes, including throughout 2022. This non-public supervisory activity is what’s going to generate a greater number of enforcement matters and, subsequently, more public investigations, which will come to light. So, while there might not have been as many public cases, particularly from 2021 to 2022, as we initially anticipated, I'm of the opinion that whether it's in 2023 or 2024, the non-public activities that we’ve seen over the past year and a half to two years will progressively find their way into the public domain.”

Counsel, Goodwin (via COMPLY by PerformLine)

Key Takeaways for Your Organization

Consumer Complaints Matter

Regulators collect and analyze consumer complaints to understand the situations consumers are encountering in the financial marketplace, develop rules, and guide supervisory and enforcement actions. Organizations must recognize the importance of consumer complaints as a valuable source of information to identify potential risk management weaknesses, compliance deficiencies, and emerging issues. By actively monitoring and analyzing consumer complaints, organizations can gain valuable insights into the challenges consumers face, enabling them to proactively address these issues and enhance their compliance programs.

Increased Consumer Awareness

The data reveals a growing awareness among consumers regarding their rights and expectations from their financial services providers. Consumers are becoming more informed about their ability to submit complaints and are not hesitant to do so. This trend signifies a shift in the consumer mindset, emphasizing the need for organizations to be proactive in addressing potential compliance issues. Organizations should communicate clearly with consumers, provide transparent information, and promptly resolve complaints to ensure consumer satisfaction and loyalty.

Keep Up with Complaint Trends

Staying informed about complaint trends is crucial for any effective compliance program. By closely monitoring complaint data, organizations can identify patterns and emerging issues impacting their industry. This proactive approach enables organizations to avoid potential compliance risks and take appropriate measures to address them.

Avoid Consumer Complaints and Enforcement Actions with a Strong Marketing Compliance Program

Ensuring all marketing and sales communications with your consumers are compliant and transparent is critical to building trust.

PerformLine is built to help compliance teams protect their brands by mitigating risk in their marketing and sales channels while gaining efficiency through automation.

With PerformLine, organizations like yours can monitor all of its marketing channels and partners at scale to better protect consumers and avoid the complaints that lead to investigations and enforcement actions by the CFPB.